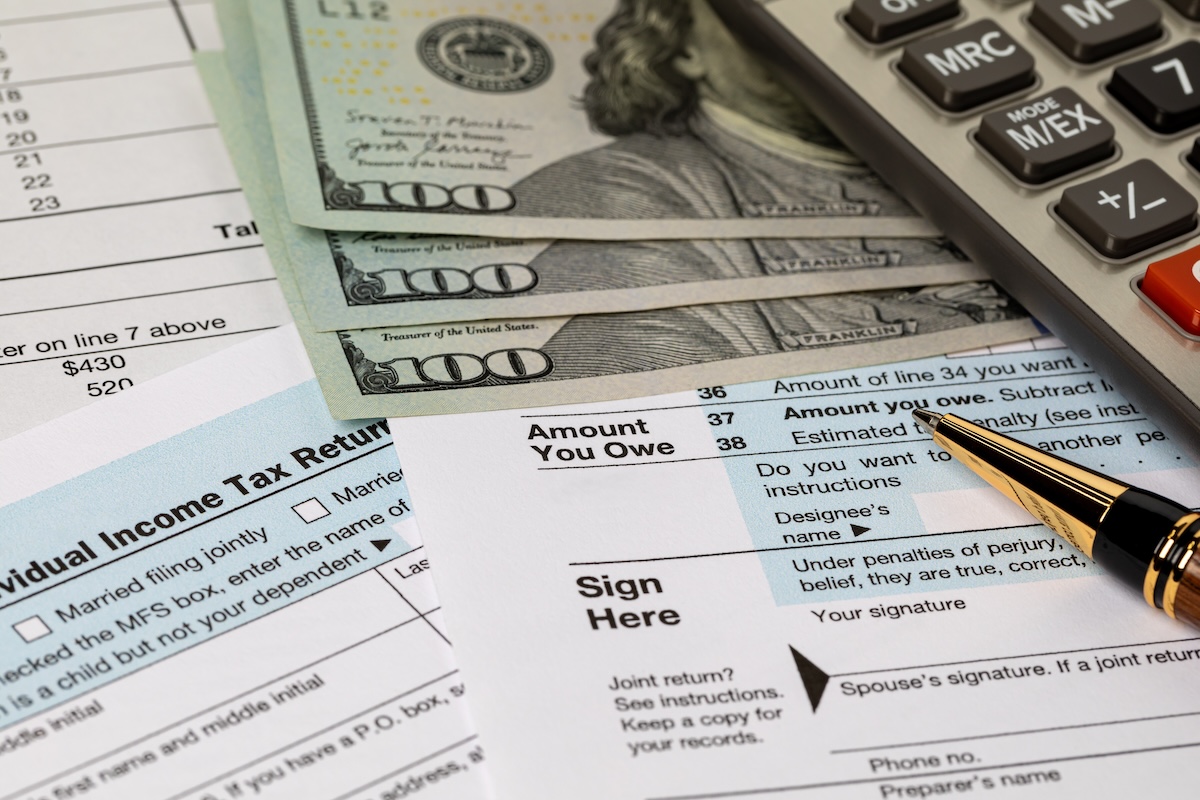

Key Tax refund dates for 2025: What you need to know

INTERNACIONAL

30-12-2024

Photo web

Publicado: 30-12-2024 13:48:17 PDT

Actualizado: 30-12-2024 13:53:09 PDT

Tax filing with the Internal Revenue Service (IRS) begins in january

The Internal Revenue Service (IRS) will begin accepting electronic tax returns on January 21, 2025, marking the start of the 2024 tax filing season. The deadline to file returns without an extension is April 15.

The IRS estimates that taxpayers who file electronically and choose direct deposit as their refund method will receive their money within 21 days. However, paper returns sent by mail could take up to 12 weeks to process.

Refunds related to credits such as the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) will be held until mid-February in compliance with the PATH Act, a measure designed to prevent tax fraud.

You might also be interested in its Spanish version: Fechas clave de reembolsos de impuestos 2025: lo que debes saber

The IRS encourages taxpayers to file early, carefully review their information to avoid errors, and opt for direct deposit to expedite the process. Additionally, the agency offers the “Where’s My Refund?” tool to track the status of refunds.

For those needing more time, the deadline to file with an extension is October 15, but taxes owed must be paid by April 15 to avoid interest and additional penalties.

Nacional

hace 32 minutos

La mandataria también reconoció el esfuerzo de los migrantes poblanos en Estados Unidos ..

Deportes

hace 39 minutos

La bajacaliforniana buscará su cuarta victoria en UFC ..

Cali - Baja

hace 1 hora

La escultura, encargada al artista tijuanense Oscar Ortega Corral en enero de 2024 mediante adjudica ..

Cali - Baja

hace 2 horas

La alcaldesa Norma Alicia Bustamante Martínez anunció también que, además del incremento salarial, l ..

Cali - Baja

hace 2 horas

Con esta iniciativa, Coparmex Mexicali busca fortalecer la preparación del sector empresarial ..

Cali - Baja

hace 2 horas

Los elementos de la Dirección de Seguridad Pública Municipal (DSPM) aseguraron el arma utilizada en ..